With Stripe plus the Bench app, you can keep track of more than just payments. The IRS’s Business Expenses guide provides detailed information about which kinds of bad debt you can write off on your taxes. In addition, a company’s net receivables are highly subject to general economic conditions. Regardless of the entity’s procedures, the figure tends to worsen as financial conditions worsen in the general economy. Also, a specific identification method may be used in which each debt is individually evaluated regarding the likelihood of being collected.

Treatment of accounts receivables in financial statement

What would you do if you found yourself unable to pay for your business overhead, payroll or goods received from vendors? Failure to track your accounts receivable could cause cash flow problems for your business down the road. For example, let’s say James wants to purchase a $1,200 washing machine but doesn’t have the cash at the time of the sale.

What is treasury management and how does it work

When a business owes an amount to another party, they are liable to pay that debt. All of these count as receivables as the cost to the customer is due after they have already received the goods or services. Thank you for reading this guide to Accounts Receivable (AR) and how it impacts a company’s cash flow. CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

How the Bench App Helps You Assess the Health of Your Business

Accounts Receivable (A/R) is defined as payments owed to a company by its customers for products and/or services already delivered to them – i.e. an “IOU” from customers who paid on credit. Because it highlights your company’s liquidity, the accounts receivable turnover can be a great tool for financial analysis that can help you gauge your revenue definition company’s financial health. It can also reveal your business’s ability to maintain consistent cash flow without the need to convert larger assets into cash. The April 6 transaction removes the accounts receivable from your balance sheet and records the cash payment. You receive the cash in April but correctly recorded the revenue in March.

- It helps you track, monitor, and on-time action on overdue/long-pending bills resulting in an increased inflow of cash that is essential for business growth.

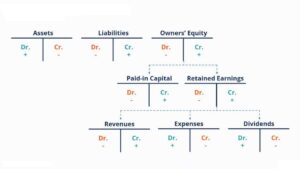

- To assist the assessment of solvency, accountants categorize receivables based on when they are due.

- You can do this manually by preparing and sending a paper bill through the mail or electronically.

- Investors and lenders often review a company’s accounts receivable ratio to determine how likely it is that customers will pay their balances.

- To determine profitability, add up all your assets, including accounts receivable, and subtract your total accounts payable, or liabilities, which are what you owe to suppliers and vendors.

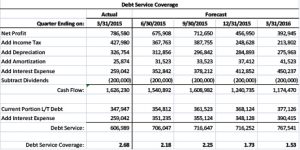

Pools or portfolios of accounts receivable can be sold to third parties through securitization. The net cash impact is negative since the days sales outstanding (DSO) is increasing each period. Starting from Year 0, the accounts receivable balance grew from $50 million to $94 million in Year 5, as captured in our roll-forward.

Here’s an example of an accounts receivable aging schedule for the fictional company XYZ Inc. Alternatively, it can simply calculate the net receivables by applying the estimated collection rate for each range. The concept behind an aging https://www.personal-accounting.org/ schedule is to apply different collectibility rates to different receivables based on age. In any event, any contingent liability arising from discounted notes treated as sales should be disclosed in the notes to the financial statements.

Meanwhile, accounts receivable is the money you receive from selling goods and services that leads to revenue. Accounts receivable refers to money customers owe your business so it is considered an asset. Some examples include bills or pending payments for services rendered to clients or consumers. If you don’t keep track of accounts receivable, you may forget to bill certain customers, or you may not know if you’ve been paid.

Only keep offering credit to customers who meet their payments on time. If you have recurring customers that don’t fulfill their debts, consider reviewing their credit relationship with your business. You can send them warnings initially and cut off their https://www.accountingcoaching.online/does-u-s-gaap-prefer-fifo-or-lifo-accounting/ credit after recurring failures to pay on time. Your company can use accounts receivable as collateral for loan applications and to fulfill short-term money obligations. It can be a tedious process because businesses receive thousands of payments.

Generally, collecting a balance too quickly can put undue stress on clients with good standing. However, waiting too long to collect can cause you to lose the opportunity for payment. Selecting the ideal times to allow delayed payment will help you keep a good balance between being flexible and ensuring prompt payment.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. When goods are sold on credit, the seller is likely to be an unsecured creditor of its customer. Therefore, the seller should be cautious when selling goods on credit. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. With both these characteristics of receivables, their accessibility and fast return, they become a vital source of working capital for your company to use daily.

When Jane pays it off, the money would go back to the sales amounts or cash flow. When a company owes debts to its suppliers or other parties, these are accounts payable. To illustrate, Company A cleans Company B’s carpets and sends a bill for the services. Delayed payments from customers can cause the accounts receivables on the balance sheet to increase.

To help financial statement readers assess a company’s earning power, GAAP call for the reporting of interest income earned from receivables and the losses incurred through non-collection. Offer customers multiple payment options so it’s easy for them to pay. For instance, you could let them pay by credit card, debit card or ACH. Similar to contracts with suppliers, payment terms range from net-30 to net-60 or net-90. For bulk orders, you may be required to pay a specific amount upfront. A typical invoice would include the amount due, deadline and sales tax.

The balance of money due to a business for goods or services provided or used but not yet paid for by customers is known as Accounts Receivable. These are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date. Company B owes them money, so it records the invoice in its accounts payable column. Company A is waiting to receive the money, so it records the bill in its accounts receivable column.

Accounts receivables are also known as debtor, trade debtors, bills receivable or trade receivables. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Notes have a specific definition under GAAP but for the most part, this will be an IOU from one company to another that may or may not get paid off in time.