Easy to share information with your accountant and to find QuickBooks experts and online resources if needed. Another thing to consider is the learning curve and overall platform UI. However, you may be able to use the AI chatbot and robust support center to get answers to your questions. Just search for your issue to see if there’s a support article about it. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

Unlimited users for a low cost

You can use Xero for free for 30 days before signing up for a paid subscription. For processing online payments, Xero integrates with Stripe, PayPal, and GoCardless. I just started my business and have been using the trial of xero for 2 weeks now.

Time and mileage tracking

You’ll need the Plus plan to access a general ledger, trial balance or chart of accounts and the Premium plan to create any accounts payable reports. With a free plan and paid plans starting at $20 per month, Zoho Books has plans for most budgets. Higher-tier plans include unique features, like workflow rules, on top of tools that help you measure project profitability. Phone support and live chat support are available 24/5 to all paying customers, but third-party integrations are limited compared to QuickBooks Online and Xero.

Wave vs. QuickBooks Online: Comparing Cost and Features

Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios. One of the advantages of using Xero is that it can save businesses time and money. With Xero, businesses can eliminate the need for paper records and reduce accounting fees. The software is also updated automatically, so businesses always have the latest features and security patches.

All debit card purchases automatically will get logged and categorized. You’ll be able to reconcile your accounts, set up automatic payments, and track your invoices. These apps let you perform accounting tasks, such as creating invoices, reconciling bank transactions, and managing expenses. The Xero desktop apps can be a useful tool for users who prefer a more traditional, desktop-based experience. In June 2020, Wave launched Wave Money as “the future of small business banking”.

- Xero‘s user experience and beautifully-designed interface are also hard to beat.

- If we compare Xero vs Wave in terms of pricing, they have their differences.

- Xero is ideal for businesses that keep a team of bookkeepers or accountants in-house.

- Users of the free software can’t get assistance from a live agent.

FreshBooks doesn’t offer quite as many connections, with just 100 partner apps. However, you’ll be able to find integrations to help you analyze data, book appointments, manage projects, run payroll and so much more. You can enjoy project conversations, file sharing and project due dates, but these features are most helpful for individual https://www.wave-accounting.net/ or small-team projects. Choosing the right accounting software can ensure your small business manages its finances well. If you’re searching for the best accounting software, you might be on the fence between FreshBooks and Xero. Both made our list of top QuickBooks alternatives, meaning they’re functional, powerful and easy to use.

Unfortunately, Wave doesn’t come with inventory management functionality. If you need basic expense-tracking functionality, Wave can be a solid option. Although Wave offers a solid number of invoicing features, Xero’s features are more developed. Xero integrates with 800+ third-party apps and tools to streamline your workflows. Additionally, the software integrates with thousands of more apps via Zapier. Wave’s knowledge base contains help articles and video tutorials.

QuickBooks also has a more intuitive interface than Xero as well as a desktop version. Making the right choice for your needs, however, entails getting to know which solution presents the most suitable package whos included in your household of functionalities. You need to start off by outlining your criteria for the financial software that you want to have. Make sure to list any specificities about your business that require a special feature.

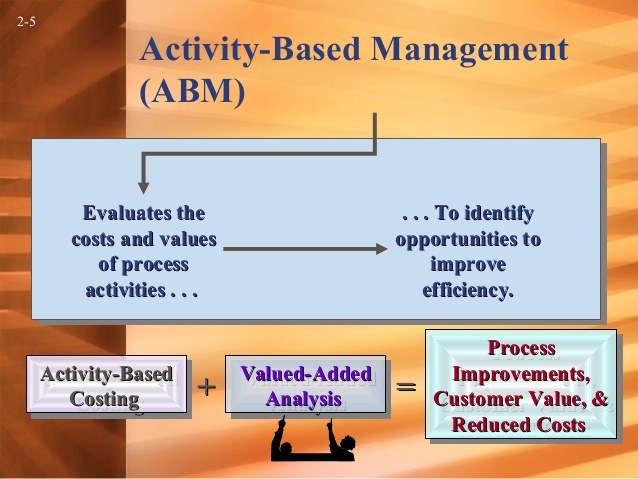

Xero’s user interface (UI) is modern, intuitive, visually appealing, and well-structured. However, the software has a steeper learning curve than other accounting software. It may take some time to get familiar with all its features, but once you get the hang of it, it becomes much easier to use. Now that we’ve compared https://www.kelleysbookkeeping.com/activity-cost-driver/ in terms of pricing, free plans, and customer service, it’s time to see how they stack up against each other in features and functionality. Wave also has paid add-ons, including Wave Payroll, which starts at $20/month for self-service states and $40/month for tax-service states.

Katherine Haan is a small business owner with nearly two decades of experience helping other business owners increase their incomes. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. If you are a freelancer, solopreneur, or self-employed professional who doesn’t have complex bookkeeping needs, Wave is an affordable, DIY solution. We’ve taken the non-promotional pricing into consideration for the purposes of this article.